NDI works with diverse partners in the disability community and public and private sectors to improve informed, financial decision-making and financial health for people with disabilities nationwide.

NDI’s Disability Inclusive Financial Counseling initiative focuses on the promotion of financial equity for individuals living with a disability by training financial and housing counselors to be more disability inclusive, increasing access and use of tailored financial counseling/coaching services for persons with disabilities, and creating an ecosystem of collaboration and effective referral partners to these trained counselors.

Why It Matters

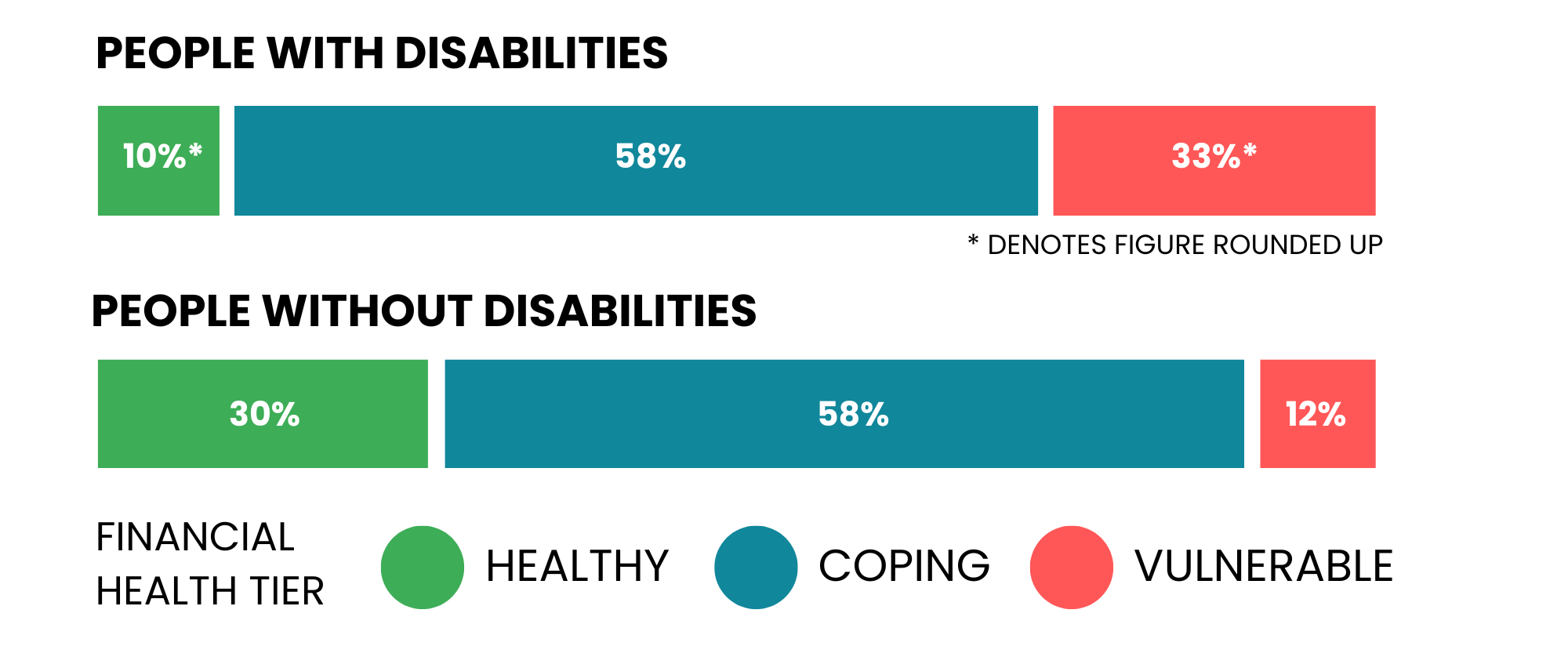

Only 10% of working-age people with disabilities are Financially Healthy and a third are Financially Vulnerable, meaning they have little or no emergency savings and high levels of debt.

Financially Vulnerable people live in a precarious financial state, often having little or no emergency savings, high levels of debt, and insufficient income to meet month-to-month expenses. Overall, working-aged people without disabilities are three times more likely to be Financially Healthy than working-aged people with disabilities and only one-third as likely to be Financially Vulnerable.

Source: The Financial Health of People With Disabilities (Financial Health Network)

Financial and housing counseling services are more effective and impactful when all aspects of an individual are considered. Community service organizations tend to focus on serving one aspect of an individual such as addressing their disability needs or their financial empowerment needs.

However, just as an individual’s lived experience is greater than the sum of his or her identities, the effectiveness of services offered are greater when informed by the overlapping challenges and opportunities individuals face at the intersection of disability, race, ethnicity, and poverty.

We are witnessing the positive effects of providing tailored financial counseling to people with disabilities and their families.

Results So Far: Data from Louisville’s FEC, Apprisen and United Bay Area SparkPoint Centers, November 2022-May 2024

Initial participant outcomes from our original pilot partners in UWBA and Louisville include:

- Increased income: 11% Average of $799

- Increase in Financial assets acquired (bank accounts, credit cards) ABLE accounts specific

- Increase in savings 16% average of 2,302

- Increased Credit Opportunities: 12% increased credit scores

- Decreased Debt: 22% with an average of 7K reduction

What We Do

Training

NDI provides training to financial and housing counselors/coaches through a hybrid methodology of online training and a one-time in-person training.

Ongoing Support

After completing NDI’s training, financial and housing counselors/coaches are invited to participate in national support network.

Community Connections

NDI works with local partners to build relationships and provide resources needed to help you more effectively reach individuals with disabilities.

Training

NDI provides specialized training to equip financial and housing counselors/coaches to better serve individuals with disabilities. Training focuses on:

- Equipping coaches with a better understanding of disability benefits and how disability benefits (like SSDI and SSI) may influence financial decisions and potential limitations

- Learning how to create a more inclusive and supportive environment by learning and building a better understanding of the unique financial challenges faced by people with disabilities

- Ensuring that financial information provided doesn’t jeopardize access to vital benefits and learning to make effective referrals to the identified appropriate referral sources for additional support.

Participating counselors are provided approximately 30 hours of training, through a hybrid methodology of self-paced online learning and live virtual technical assistance paired with a one-time 2-day in-person training, tailored to the needs of partnering organizations.

Training Topics Include:

- Disability benefits administered by the Social Security Administration (SSA), including Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) and how to apply this knowledge during financial counseling sessions with individuals receiving these benefits

- A better understanding of the Disability service system, its providers and networks

- Disability awareness and disability sensitivity training

- Understanding the Financial Experience of People with Disabilities

- Navigating overpayments: debts owed to SSA

- Disability accommodations and accessibility to include virtual and physical accessibility to service access as well as understanding accommodations and the elements of an accommodation plan.

- Guidance on effectively asking about disability during intake and during the counseling process.

- Work incentives and opportunities for individuals receiving SSDI and/or SSI.

- The basics of what an ABLE account is and how it can be used as a financial empowerment tool.

Technical assistance (TA) office hours:

Participants have ongoing access to subject matter experts through TA office hours. These sessions provide a platform to ask questions and discuss challenges related to both the training materials and practical counseling experiences.

Ongoing Support

Disability Inclusive Financial Counselor National Network

After successful completion of the training component, trained financial and housing counselors/coaches receive a certificate of completion, and are invited to join a supportive network of fellow counselors. This national network meets every month and members have the opportunity to access subject matter experts to have their specific questions answered at any time.

Members have access to:

-

- Expert Guidance with access to subject matter experts who answer questions, provide guidance and facilitate discussion and answer queries related to serving clients with disabilities with one on one support available.

- Tools and resources featuring frequent guest speakers selected based on the member feedback and needs.

- Peer-to-Peer Learning with regular meetings with other trained counselors to share experiences and best practices.

- Online Collaboration through a dedicated online platform for peer-to-peer support and interaction with NDI experts.

- Continuous Learning via regular workshops, webinars, and guest speaker sessions on relevant topics.

Community Connections

NDI works with local partners to create synergies between key stakeholders that are needed to effectively reach individuals with disabilities. This includes organizations serving individuals with a disability, organizations offering financial counseling/ financial coaching services and other organizations serving underrepresented groups.

Interested in Partnering, Training, or Learning More?

For more information about opportunities for partnership, training for your team, project details, and more, contact Katie Metz.

Current Partners

Louisville Metro’s Office of Financial Empowerment was the first anchor partner. They recruited the Louisville Financial Empowerment Center (FEC), AcceLOUrate Savings (now combined with the FEC), Apprisen and Goodwill Kentucky counselors to participate.

For More Information:

Erin Waddell

Louisville Metro’s Office of Social Services

erin.waddell@louisvilleky.gov

United Way Bay Area was selected as the second anchor partner. Their participating counselors were selected through their SparkPoint Centers.

For More Information:

Elizabeth Maggio

United Way Bay Area

emaggio@uwba.org

Wayne Metropolitan: Community Action Agency was selected as the third anchor partner. Their trained team includes counselors from the Detroit Financial Empowerment Center, Lighthouse, and MiSide.

The Allegheny County Financial Empowerment Center, a partnership between Neighborhood Allies, Allegheny County Department of Human Services, and Advantage Credit Counseling Service, Inc. is our anchor partner in Pittsburgh. They recruited additional partners from Catapult Greater Pittsburgh and NeighborWorks Western Pennsylvania to have additional counselors trained under NDI’s DIFC model.

For More Information:

Sarah Dieleman Perry

Neighborhood Allies

Sarah@neighborhoodallies.org

In Central Iowa, the Polk County Financial Empowerment Center, operated by Polk County, leads the NDI DIFC initiative as our anchor partner. Counselors from Lutheran Services, Great Des Moines Habitat for Humanity, Des Moines Municipal Housing Agency, Iowa Vocational Rehabilitation Services, and OLC Interpreter Consulting LLC participated in the training to strengthen disability-inclusive financial counseling across the region.

Resources

Additional Training Tools for Counselors

NDI aims to promote financial equity for all people with disabilities. For more information about these statistics, please review Race, Ethnicity and Disability: The Financial Impact of Systemic Inequality and Intersectionality and other NDI Reports.

NDI’s Financial Resilience Center (FRC) is an online information hub to help people with disabilities and chronic health conditions build their financial resilience and navigate through difficult times. This website provides trusted answers to frequently asked questions related to employment, benefits, credit, taxes, housing and more including assistance to help individuals manage their finances.

NDI’s ABLE National Resource Center is connecting people with disabilities, their families and those who support them to information about the Achieving a Better Life Experience (ABLE) Act and ABLE accounts to learn, save and grow.